- #Quickbooks 2018 desktop record employee hours how to

- #Quickbooks 2018 desktop record employee hours pro

This amount isn’t included in W-2 Boxes 1, 3, 5, or 7.įor information on how to report tips on your return, see your Form 1040 instructions or IRS Pub.

0.9% Additional Medicare tax on any of those Medicare wages and tips above $200,000īox 7 - Shows any tip income you reported to your employer.īox 8 - Shows tip income allocated to you by your employer. 1.45% Medicare tax withheld on all Medicare wages and tips shown in Box 5. See Form 1040 details to determine if you’re required to complete Form 8959.īox 6 - Shows the amount of Medicare tax withheld. The amount, which also may not be the same as the amount reported in W-2 Box 1, might be required on Form 8959, Additional Medicare Tax, if your income is high enough. Include this amount on the federal income tax withheld line of your return (Form 1040, line 25a).īox 3 - Shows your wages subject to Social Security tax, which could be different on what’s reported on Box 1.īox 4 - Shows the amount of Social Security tax withheld from your pay.īox 5 - Shows your wages subject to Medicare tax. If you have more than one Form W-2, or you are married and your spouse also has one or more W-2s, the total of all forms’ Box 1 will be shown on Form 1040, line 1.īox 2 - Shows the total federal income tax withheld from your paycheck for the tax year. You should include this amount on the wages line of your return. #Quickbooks 2018 desktop record employee hours pro

This video is from our complete QuickBooks tutorial, titled “ Mastering QuickBooks Desktop Pro Made Easy v.2021.Box 1 - Shows your wages, tips, prizes, and other compensation for the year. You can watch the following video lesson, titled “ Creating Termination Paychecks,” to see how to create termination pay in QuickBooks Desktop Pro.

If printing the paychecks within QuickBooks, click either the “Print Paychecks” or “Print Pay Stubs” button, as needed.Ĭreate Termination Pay in QuickBooks Desktop Pro: Video Lesson. To create the paychecks, click the “Create Paychecks” button. After entering or editing the paycheck details, click the “Save & Close” button. Click the hyperlinked name of the employee in the list to open the “Preview Paycheck” window if you need to review and edit the payroll information. In the next screen, select whether to print the checks or assigned check numbers in the “Check Options” section. Click the “Continue” button to continue creating the paychecks. This updates their information within their employee record when you create the paychecks. To the right of their names, under the “Release Date” column, enter the employee’s release date. Then place a checkmark next to the names of the employees who need a termination check. Select the account from which the funds will be withdrawn from the “Bank Account:” drop-down. Manually set the “Pay Period Ends” and “Check Date.”. To create termination pay in QuickBooks, select “Employees| Pay Employees| Termination Check” from the Menu Bar to open the “Enter Payroll Information” window. Create Termination Pay in QuickBooks Desktop Pro: Instructions If printing the paychecks within QuickBooks, click either the “Print Paychecks” or “Print Pay Stubs” button, as needed. To create the paychecks, click the “Create Paychecks” button. After entering or editing the paycheck details, click the “Save & Close” button. Here, you can review and edit the payroll information, if needed. Then click the hyperlinked name of the employee within the list to open the “Preview Paycheck” window.

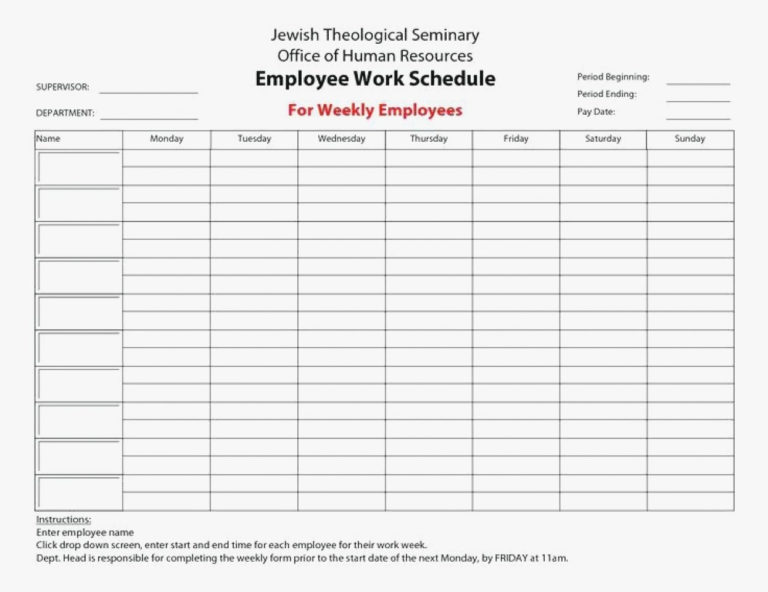

In the next screen, select whether to print the check or assign it a check number in the “Check Options” section. Then click the “Continue” button to continue creating the paychecks.Ĭreate Termination Pay in QuickBooks Desktop Pro- Instructions: A picture of the initial screen that appears when you create termination paychecks in QuickBooks Desktop Pro. This information is updated within their employee record when you create the paychecks. To the right of their names, under the “Release Date” column, enter the employee’s release date.

Then place a checkmark next to the names of the employees who need a termination check. Then select the account from which the funds will be withdrawn from the “Bank Account:” drop-down. Manually set the “Pay Period Ends” and “Check Date” dates. Doing this then opens the “Enter Payroll Information” window.

To create termination pay in QuickBooks Desktop Pro when an employee leaves, select “Employees| Pay Employees| Termination Check” from the Menu Bar. This tells QuickBooks Desktop Pro that the employee no longer needs regular, scheduled paychecks in the future. Doing this lets you edit the termination paycheck information and enter the employee’s release date. Unlike normal, scheduled paychecks, you can create termination pay in QuickBooks Desktop Pro when an employee leaves the company. Create Termination Pay in QuickBooks Desktop Pro: Overview

0 kommentar(er)

0 kommentar(er)